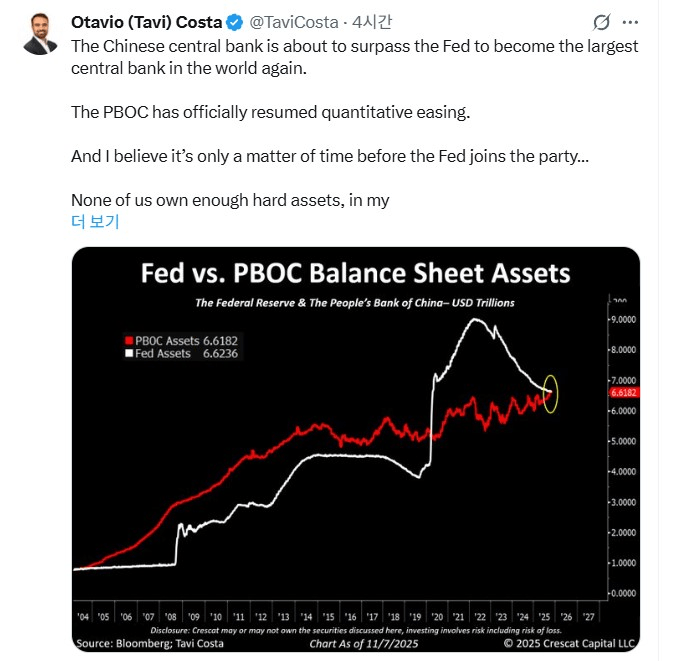

The simultaneous liquidity expansion by the Fed and PBOC historically benefits Risk Assets and Hard Assets.

1. AI Infrastructure & Power Grids

- Logic: The shift to AI inference requires massive computing power and grid modernization. This intersects US tech growth with global manufacturing recovery.

- Top ETFs:

- SMH: Semiconductors (Nvidia, TSMC)

- GRID: Smart grid equipment and transformers

- XLU: Utilities (increasingly valued for data center power supply/nuclear)

2. Industrial Metals (Commodities)

- Logic: PBOC infrastructure stimulus + Weaker USD = Rally in raw materials, specifically Copper (electrification) and Lithium (EV recovery).

- Top ETFs:

- COPX: Copper miners (high leverage to copper prices)

- LIT: Lithium & Battery tech (high sensitivity to China’s recovery)

- DBC: Broad commodities (Inflation hedge)

3. Chinese Big Tech

- Logic: Historically low valuations combined with regulatory easing and direct liquidity injections make this sector a prime target for mean reversion.

- Top ETFs:

- KWEB: China Internet giants (Tencent, Alibaba)

- CQQQ: Broad Chinese technology sector

4. Bitcoin (Liquidity Proxy)

- Logic: Crypto has the highest correlation with Global M2 (money supply) growth, acting as a “liquidity sponge” and hedge against fiat debasement.

- Top ETF:

- IBIT: Spot Bitcoin ETF

댓글 남기기